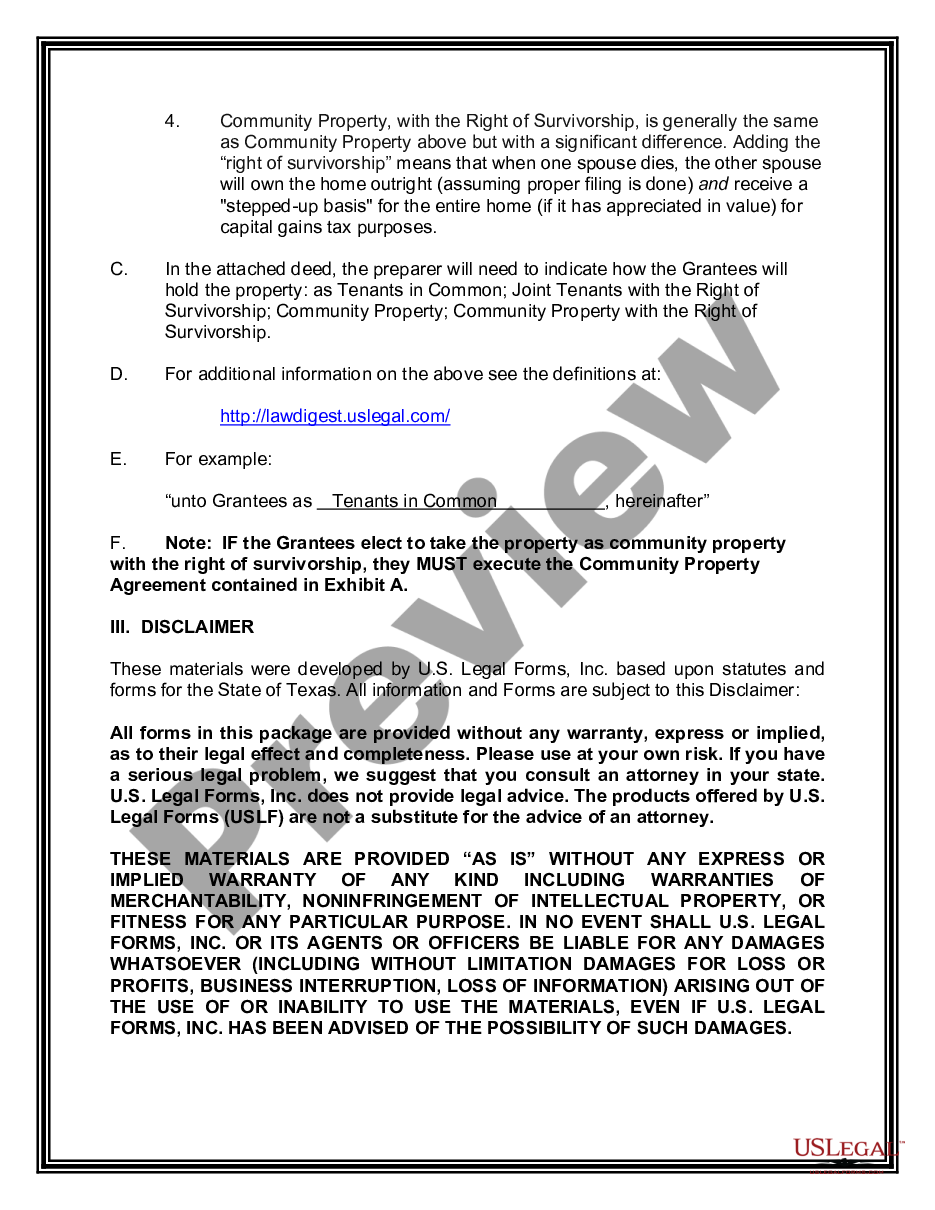

Texas Warranty Deed for Husband and Wife Converting Property from Tenants in Common to Joint Tenancy - What Is A Conversion Deed | US Legal Forms

How are Capital Gains in Irrevocable Trust Taxed? - Legacy Design Strategies - An Estate and Business Planning Law Firm