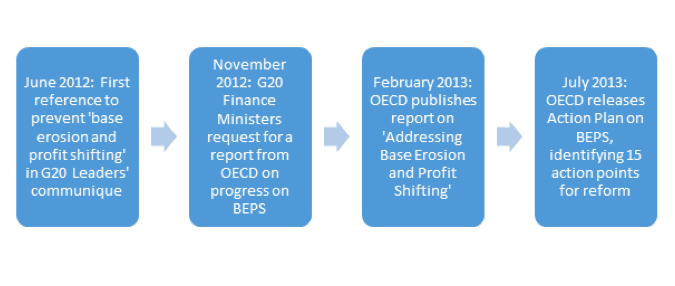

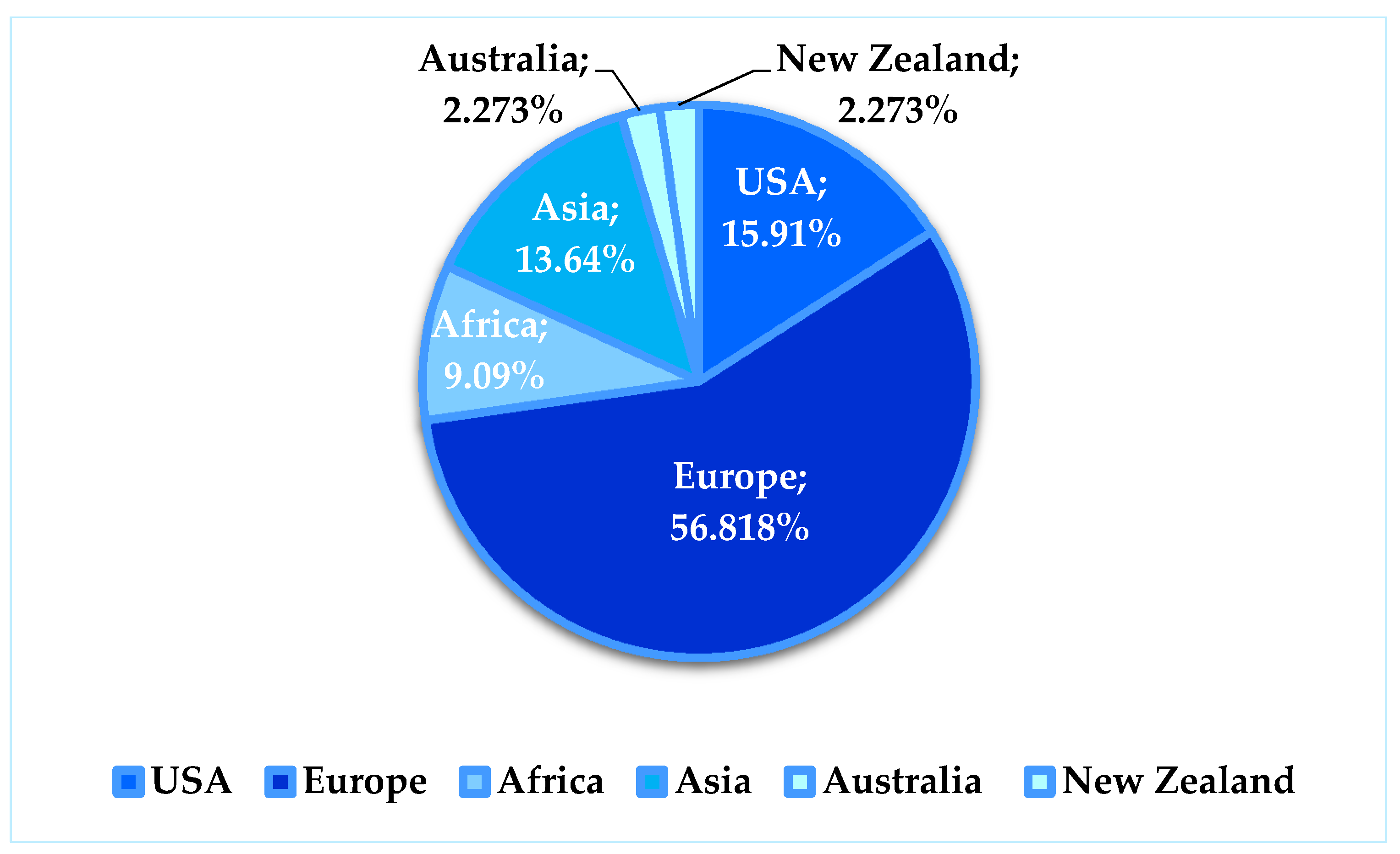

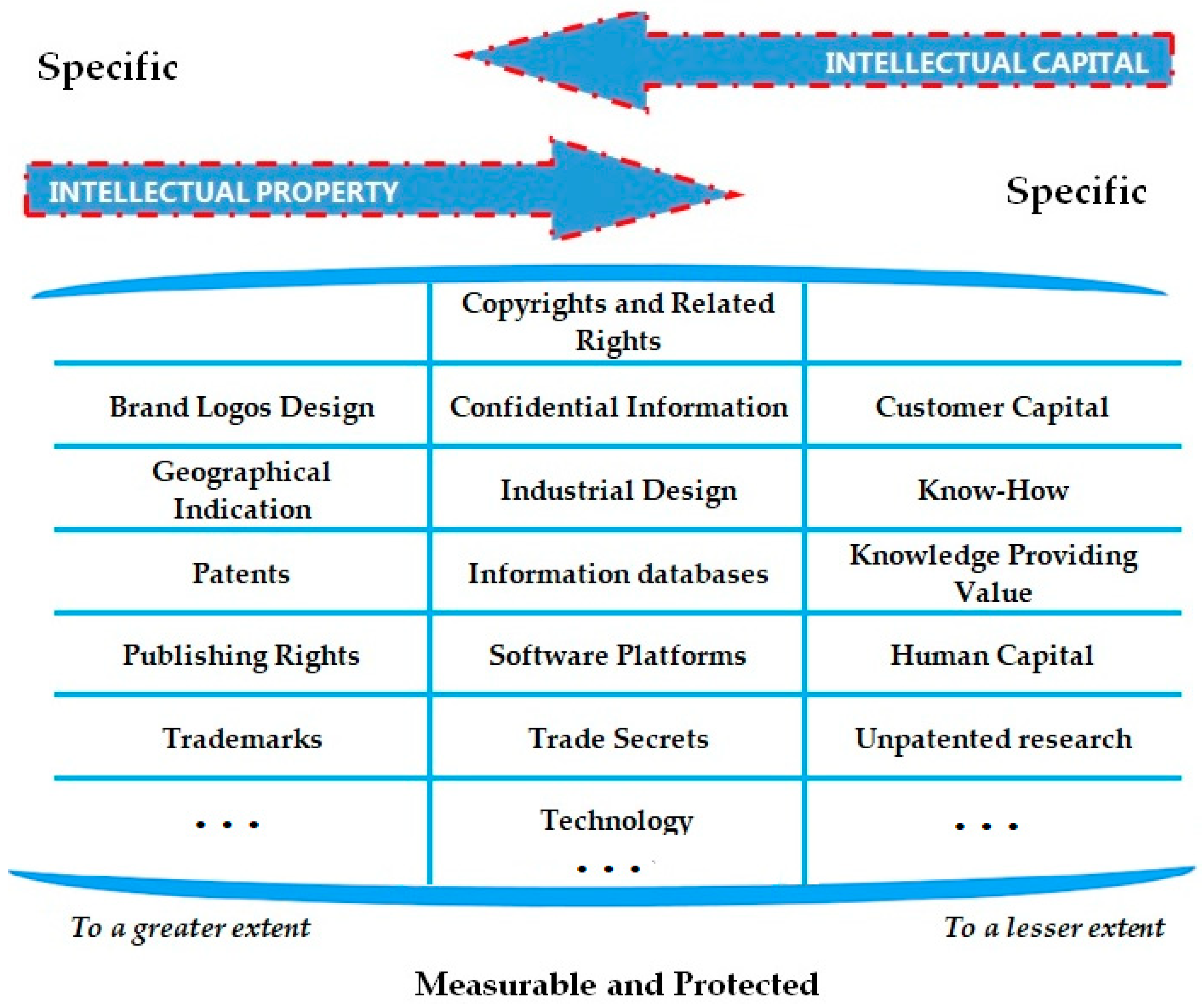

Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual

Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual

Addressing Base Erosion And Profit Shifting by OECD Organisation for Economic Co-operation and Development | Goodreads

Oecd/G20 Base Erosion and Profit Shifting Project Addressing the Tax Challenges of the Digital Economy, Action 1 - 2015 Final Report: Organisation For Economic Co-Operation And Development, Oecd: 9789264241022: Amazon.com: Books